Supremex Inc. manufactures and markets envelopes, and paper packaging solutions and specialty products to corporations, resellers, government entities, SMEs, and solutions providers in Canada, and the Northeastern and Midwestern United States. The company offers a range of stock and custom envelopes in various styles, shapes, and colors; corrugated boxes, and folding carton and e-Commerce fulfillment packaging solutions; polyethylene bags for courier applications and bubble mailers. It serves various industries, including food, pharmaceuticals, cosmetics, and personal care products. The company was founded in 1977 and is based in LaSalle, Canada.

Supremex’s position as the dominant market leader for envelopes in Canada (85% share) allows it to generate a ton of free cash flow that it can then use to self-fund its entrance into the packaging and specialty products market. Management has overseen the pivot over the last 5 years and has thus far done a terrific job at turning the cash flows from their dying envelope business into promising growth opportunities in the packaging segment, which is no easy feat. Supremex has a vast network of manufacturing facilities and distribution centres which allows it to enter a secular growth market with both a ton of management expertise, and the infrastructure in place to make a real dent in the market. All-in-all, Supremex can reach 60% of the US market within 800km for the US envelope business, and there is no reason to believe they can’t say the same for packaging.

The Company’s overall growth strategy focuses mainly on inorganic growth and harvesting the potential synergies due to their expertise and network, allowing them to create even more free cash flow. Some recent examples are acquisitions of Royal Envelope Corporation and Impression Paragraph Inc., which were growth opportunities in the US envelope market and the packaging market, respectively.

The company paid between very cheap prices (0.5-0.7x sales) for businesses that will expand their distribution network, improve their offerings, and allow for even more future growth of revenues. Acquisitions are no certainty, but between management’s 100+ years of experience and history of strong growth through acquisition, it is easy to feel comfortable with their choices, especially when Supremex trades at such a cheap multiple on several fronts: P/E, EV/EBIT, EV/FCF – you name it. Once the market realizes Supremex is no longer a dying envelope company, they will likely rerate higher, and even should that not occur, there is a significant margin of safety due to the underlying success of the envelope business that will keep them afloat as they navigate the transition, which they are currently managing quite well.

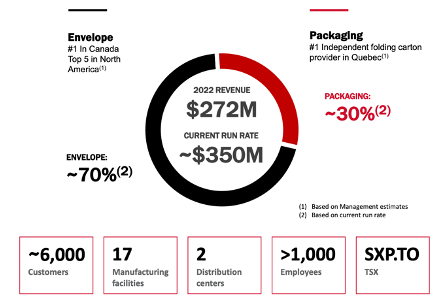

Despite the secular decline of the envelope market, Supremex continues to harvest free cash flows to fund transition. At first glance, it is easy to write off Supremex as an envelope manufacturer that has an effective monopoly in the Canadian envelope space but is destined for despair going forward. Fortunately, that is likely far from the truth. While their revenues from the envelope segment currently constitute 73.5% of revenues, that number is down from 80.7% in 2016, and should continue to shrink going forward (the current run rate has the split at 70/30). Furthermore, despite the decline in volume from the envelope segment, Supremex management has done an outstanding job at passing on inflation to their customers, leading to a 28.6% increase in the average selling price per envelope year-over-year, and annual envelope revenue growth of 27.4% as they continue to self-fund growth opportunities.

The Company continues to earn extremely high returns on invested capital (ROIC) despite economic headwinds as they buy up smaller companies cheaply. To earn >10% ROIC in a secular declining market is remarkable from management – I’ve calculated it to be 13% on average for the last 10 years, although there is an argument to be made that it might be higher. It took time for the market to give The Company credit, but is starting to take shape, as shares are up over 80% in the past year – and there is still room to grow, as it continues to look cheap.

Supremex has the experienced management and infrastructure in place to take advantage of new opportunities in the packaging market, overcoming a major barrier to entry for other potential competitors. As previously noted, with 2 distribution centres, 17 manufacturing facilities, 110+ years of management expertise and connections, Supremex is starting “the game” with a massive lead. Management explained in the investor presentation (and thus far has demonstrated beautifully) that the packaging business requires many of the same core competencies as the envelope business, which only strengthens the case to be made that they will be able to eventually bite off a significant chunk of this secular growth market (10.5% and 8.1% 5-year CAGR in Canada and the US, respectively). They already estimate themselves to be the #1 independent folding carton provider in Quebec, where they are headquartered, and are continuing to branch out from there.

The company’s balance sheet looks good despite recent cash acquisitions as management continues to look for potential targets. While serial acquirers tend to take on tons of debt and lever up their balance sheet to support inorganic growth at massive future costs, potentially putting shareholders in a compromised position, Supremex has done a wonderful job managing debt keep cash levels high enough that there is no real fear of short-term liquidity crunches. While there appears to be some red flags (growing inventories, high portion of assets as goodwill/intangibles), this is normal for a serial acquirer and operating leverage has started to take form for The Company. Operating margins, which got as low as 7% in 2019, have rebounded back towards the long-term average around 11.5%. Valuing the balance sheet as a starting point, I’ve left current assets alone, as I usually do, because the “reproduction value” is generally close to states values, though you could add back loss allowances, but this is somewhere around C$86m. This is where the real fun begins (yes, some of us find estimating adjusted book value fun, I know there are more of you out there!).

PP&E is where the real analysis starts. Currently stated to be worth roughly C$75m, based on the depreciation rates and specific amounts allotted to each area of PP&E (Notes 2 and 7 to their financial statements) I estimate the buildings currently on the book at C$7.5m are worth nearly double, the machinery that is depreciated quite quickly despite longer useful lives to be worth C$60m, and office equipment to be worth C$3.5m (original costs for each are C$15m, C$79m, and C$4m). The land is harder to estimate as they only own two facilities in Ebitoke, ON and Lasalle, QC, but I have not been able to determine the size of the facilities, so I estimate PP&E to be worth roughly C$75m + land.

The Company’s only intangible that I am relatively comfortable valuing is the value of their customer relationships, because due to recent acquisitions, we can see what one dollar of recurring revenue in the space is worth. They paid close to 50% of sales for their recent acquisition, so we can estimate that their current C$270m in LTM sales is worth about C$135m. With respect to goodwill (currently on the book for C$50m) I am unsure how to accurately value it, so to be safe I will cut it in half, giving us a total adjusted book value of assets for the firm of C$340m when including their overfunded pension assets, before adding the value of the land.

Backing out their liabilities, which I believe are worth about C$100m (this is likely high, but I would prefer to be safe), which leaves us with adjusted net book value of assets worth C$236m + land. It is a bit worrisome that such a large portion comes from goodwill and intangible, especially in a declining industry. To be safe, we can write goodwill down to zero, assume the value of their customer relationships are worth half what they pay, and come to a net book value of C$144m + land, which is likely right around their current market cap of C$160m, and to me this feels very close to their low point.

As it pertains to earnings power, Supremex is growing through acquisition, so we will not assume the growth necessarily creates or destroys value, as there are arguments for both. The strong, experienced management team believes the envelope business shares core competencies with their venture into packaging, however it is often more difficult than meets the eye, so I will assume sustainable revenue of C$315m (10% below their current 12-month run rate), and sustainable operating margins of 10-15% and a tax rate of 25% gives us a NOPAT range of C$24-35m.

Between 2018-2020 the company saw very little growth and had depreciation costs roughly C$1m greater than CapEx, which I believe results in future savings of C$1m per year, resulting in a sustainable EPV of C$25-36m. At the current EV of the firm, that assumes the company will be at the low end of that range and would back into a cost of capital of over 11% to justify an investment – not outrageous, but high in my opinion. I believe the firm will be closer to the high end (especially if they continue their top-line growth at their current run rate), and as a range out potential outcomes this looks attractive to me.

Furthermore, Supremex values rewarding their shareholders through a variety of tactics, including dividends and share buybacks. At the end of the day, management’s job is first and foremost to allocate capital based on shareholders, and sometimes TO shareholders – which they have done consistently for years. Supremex has consistently paid a dividend for 10+ years and continue to buy back shares due to their belief that they continue to be vastly undervalued by the market – an encouraging sign of things to come, and management’s view of potential growth opportunities. Furthermore, insiders are heavily invested themselves, with insider ownership in Supremex at over 35%. Pairing that with the 7% decrease in share count over the last 10 years, along with the continued buying of shares by insiders makes for a very encouraging short-term future for The Company.

Finally, on a relative basis, the company looks incredibly cheap, and is pricing in little-to-no growth as the most likely outcome for Supremex. Recently, Supremex was trading at sub 7x net earnings, or roughly 7.5x FCF on an enterprise value basis. Looking solely at the numbers ignoring the qualitative factors of the business analysis, this is a company with a strong balance sheet, past acquisition success, high returns on invested capital, significant revenue growth over the last 5-10 years, and rewards shareholders with both buybacks and dividends when it does not see strong opportunities for cash flow allocation elsewhere. Additionally, from a cash flow generation standpoint, Supremex is poised to grow into the future and should rerate higher as the market continues to take note. Based on my estimates for revenue growth, margins, and capital expenditures, The Company should produce strong free cash flow over the next 5 years to fund more business acquisitions (and in turn, grow more). They have great expertise and are poised to compound share price based on fundamental growth (along with share buybacks), as well as qualitative measures of business success. Between the cheap valuation, high returns on capital, and a strong management team with strong incentives to reward shareholders, Supremex has all the making of a solid, cheap investment with potential upside and limited downside.

Great write up, enjoyed reading.